- Protests against Elon Musk unfold across the U.S., with notable unrest at Tesla dealerships, reflecting discontent with his political influence.

- Demonstrations highlight Musk’s dual role in Tesla and his influence on government efficiency, leading to several arrests in New York City.

- Tesla’s stock faces significant declines, plummeting 35% this year, impacting Musk’s wealth.

- Musk remains the world’s wealthiest individual despite a $121 billion decrease in net worth, as measured by Forbes and Bloomberg.

- Global economic fears, including a declining S&P 500 and potential trade wars, contribute to financial instability.

- Musk’s financial standing still significantly outpaces competitors like Mark Zuckerberg, emphasizing his economic dominance.

- The situation underscores how perception and influence can powerfully affect both societal views and financial markets.

A maelstrom encircles Elon Musk, as waves of protests unfurl across the United States, painting a landscape of unrest against the backdrop of Tesla dealerships. While demonstrators rail against Musk’s political influence and perceived attempts to shrink governmental functions, the reverberations of their actions ripple across the fiscal landscape.

The streets of New York City recently echoed with cries of dissent, leading to the arrest of at least nine individuals during an anti-Musk rally. The demonstrations, while punctuated by passionate activism, spotlight Musk’s controversial status due to his dual role as Tesla’s Chairman and his involvement in shaping governmental efficiency under the previous administration.

Meanwhile, Tesla’s stock bears the brunt of these sentiments, weathering a tumultuous market that has investors skittish. Shares have stumbled drastically, plummeting 35% since the year’s inception, casting shadows over Musk’s colossal wealth. Yet, even amidst this financial tempest, he retains the crown of the world’s wealthiest individual, his fortune towering above all rivals.

Forbes captures Musk’s wealth theatrics with striking precision, noting a staggering $121 billion dip from its zenith of $464 billion in December. Similar reports from the Bloomberg Billionaires Index echo this descent, marking his wealth at $330 billion amidst the sliding stock.

This financial upheaval arises not just from local dissatisfaction but a global economic tremor. A receding S&P 500 index, down approximately 2% from the year’s start, frames the challenges faced by investors worldwide, blending into fears of a burgeoning trade war and consumer retreat.

Yet, one must grasp the broader picture. Despite market gyrations, Musk’s financial empire towers significantly over his closest competitor, Mark Zuckerberg, maintaining a hefty lead in the global race for wealth.

In this storm of social and economic upheaval, a takeaway message crystallizes: perception and influence wield an extraordinary power. Whether in the streets, in stock markets, or through digital dialogues, they shape the narrative, creating echoes that transcend wealth alone. However, Musk’s fortune might continue to redefine the peaks and valleys of success amid societal scrutiny and global financial uncertainty, illustrating the complex dance between influence, public opinion, and the relentless pursuit of progress.

The Turbulent World of Elon Musk: How Protests and Perception Shape Tesla’s Future

A Deep Dive Into Musk’s Current Controversy

Elon Musk, one of the most influential figures in the tech and automotive sectors, finds himself at the center of significant social and financial turbulence. The demonstrations across the United States underscore the complex interplay between Musk’s political influence and public perception, aspects that affect not only his reputation but also Tesla’s market performance.

Understanding the Impact on Tesla’s Market Position

Tesla has experienced a dramatic drop in its stock value, with shares down 35% since the start of the year. This decline reflects broader concerns about Musk’s political involvement and the economic pressures faced globally. According to the Forbes report, Musk’s wealth has plunged by $121 billion but remains the highest globally, indicating both the volatility and resilience of his financial empire.

How-To Steps & Life Hacks: Protecting Your Investments

1. Diversify Your Portfolio: Don’t rely solely on Tesla or any single stock. Spread investments across various industries to mitigate risk.

2. Stay Informed: Follow reputable financial news and analyses from sources like Bloomberg to stay ahead of potential market shifts.

3. Consider Index Funds: Investing in options like the S&P 500 index could provide more stability amidst market fluctuations.

Real-World Use Cases: Beyond Automobiles

Tesla is not just an automotive company; it’s a leader in renewable energy. Its innovations in solar technology and energy storage systems present significant growth opportunities, especially as global environmental concerns rise.

Industry Trends and Predictions

The broader market trends, including the faltering S&P 500 index and trade war fears, highlight potential roadblocks for Tesla. However, as electric vehicles continue to gain traction, Tesla may still emerge resilient, particularly if it can capitalize on its technological advancements and expand into new markets.

Reviews & Comparisons: Tesla vs. Competitors

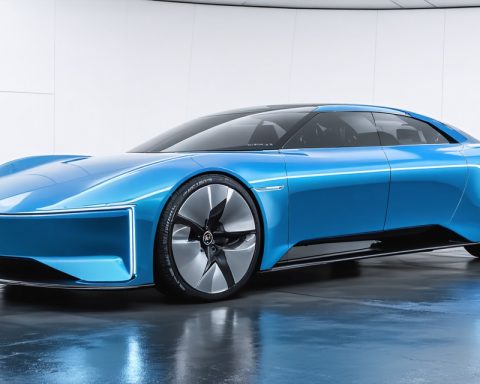

Tesla’s dominance in the electric vehicle (EV) market faces increasing competition from companies like Rivian and Lucid Motors. These competitors are making strides with innovative vehicle designs and technologies, potentially chipping away at Tesla’s market share.

Controversies and Limitations

Musk’s outspoken political stances and extensive influence in governmental discussions have sparked controversy, possibly impacting consumer and investor sentiment. Balancing this with Tesla’s brand image presents an ongoing challenge.

Pros & Cons Overview

Pros:

– Leading innovation in EV and renewable energy sectors.

– Strong brand recognition.

– Global focus on sustainability could boost long-term growth.

Cons:

– High stock volatility.

– Intense scrutiny of Musk’s actions and statements.

– Rising competition in the EV sector.

Actionable Recommendations

– Stay Adaptive: Be prepared to shift strategies based on market and public sentiment shifts.

– Monitor Innovations: Keep an eye on Tesla’s new technologies and product launches.

– Engage with Diverse Perspectives: Understanding multiple viewpoints on Musk’s influence can provide a more balanced investment strategy.

Final Insights

Elon Musk’s journey is a testament to the powerful impact of perception and influence. While protests and controversies swirled around him, his strategic decisions and Tesla’s technological advancements remain critical to weathering these storms. By staying informed and flexibly adapting to market dynamics, investors and consumers alike can navigate the complexities of this evolving landscape.