- Tech Stocks as Economic Drivers: Tech stocks play a pivotal role in the modern economy, symbolizing innovation and progress through companies like Apple, Google, and Amazon.

- Innovation and Disruption: Tech stocks fuel breakthroughs in AI, cloud computing, and digital payment systems, reshaping our world and expanding information accessibility.

- Pandemic Surge and Remote Work: The pandemic accelerated tech stocks’ growth, with companies like Zoom enabling remote work and transforming workplace norms.

- Volatility and Caution: Despite the allure, tech stocks are volatile, demanding strategic investment and resilience to balance potential gains with risks.

- Vision for the Future: Investing in tech stocks is an investment in the future, embodying human ambition and the quest for a better tomorrow.

An unseen force propels the modern economy, weaving through the digital fabric we touch every day. Tech stocks, those seemingly intangible shares of innovation and ingenuity, ignite this momentum. As the sun rises, financial markets awaken to the relentless dance of digits and data, with tech stocks leading the charge as harbingers of change.

Visualize the bustling marketplace of Wall Street, where investors pin their hopes and fortunes on the fluctuating charts of giants like Apple, Google, and Amazon. Each ticker symbol tells a story of not just profit, but potential. These aren’t just companies; they are entities of evolution, pushing the boundaries of what’s possible.

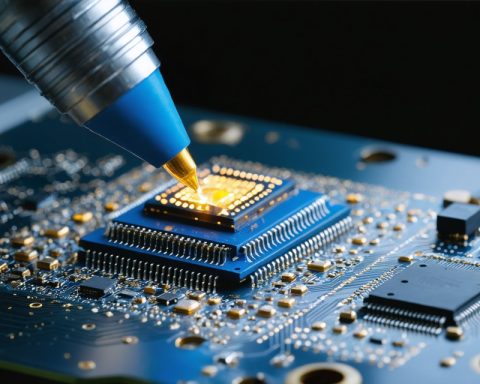

Venture into the heart of Silicon Valley, and you’ll witness how tech stocks fuel the relentless pace of innovation. Engineers and dreamers throng in air-conditioned labs, crafting the next breakthrough. Their quests for perfection lead to products that reshape our world—from AI technology refining our daily lives, to cloud computing expanding the horizons of information accessibility.

Consider the dramatic shift during the pandemic, where tech stocks soared even as the world faced unprecedented challenges. Remote work became not just a necessity, but a preferred reality, made possible by rapid advances in technology. With companies like Zoom and Microsoft Teams providing the backbone for this transformation, investors saw potential in what others perceived as chaos.

Yet, the allure of tech stocks extends beyond earnings. At the core, they represent the shared human desire to progress, to innovate, and to build a future brimming with possibilities. The rapid growth of electric vehicle companies like Tesla and the ongoing metamorphosis in the digital payments landscape underscore the significant changes underway.

But with every rise, comes a fall. The tech sector’s volatility is notorious, offering a lesson in caution even as it tempts with promise. Valuations can skyrocket one moment, only to crash the next. Investors must navigate this storm with strategic foresight and resilience, balancing ambition with prudence.

Ultimately, while today’s tech stocks carry an inherent risk, they also symbolize the pulse of progress. As we stand on the precipice of a future defined by digital innovation, tech stocks are not merely investments; they are a testament to the enduring human spirit of discovery.

The takeaway is clear: embracing tech stocks means betting on the future—one that we can shape with our beliefs and decisions. Engage actively and critically, as each share embodies not just a piece of a company, but a vision for what tomorrow can be.

Why Tech Stocks Are the Heartbeat of Modern Innovation

Expanded Insights on Tech Stocks

How Tech Stocks Drive the Economy

Tech stocks play a crucial role in the global economy. Companies such as Apple, Google, and Amazon lead substantial market sectors and are often considered bellwethers for the industry’s health. Their innovation directly fuels economic growth and significantly impacts other industries, from health care to global logistics.

Real-World Use Cases and Industry Trends

– Artificial Intelligence (AI): Tech companies invest heavily in AI, which is expected to reach $126 billion by 2025, according to a report by Tractica.

– Cloud Computing: This sector is growing with an anticipated increase to approximately $832 billion by 2025. It’s critical for industries like finance, gaming, and health care to support remote operations and data management.

– Electric Vehicles (EVs): Tesla commands attention, but companies like Rivian and Lucid Motors are also focusing on sustainable transport solutions. EV market growth is driven by both consumer demand and regulatory policies aimed at reducing carbon emissions.

Market Forecasts & Industry Predictions

Tech stocks may offer volatile returns, but they have historically outperformed many other market segments. For instance, over the last decade, the Nasdaq-100 (heavily composed of tech stocks) has surpassed the S&P 500 index in performance.

Reviews & Comparisons: Major Tech Giants

– Apple vs. Microsoft: Apple continues its expansion into wearables and services, while Microsoft leads in cloud services and productivity tools. Both companies have different strategies, with Apple focusing on consumer devices and Microsoft targeting enterprise solutions.

– Amazon vs. Alibaba: These e-commerce giants each dominate their respective markets (the U.S. and China), with Amazon expanding into cloud services and Alibaba focusing on fintech services like Alipay.

Pros & Cons Overview

– Pros: High growth potential, technological advances, diversified product lines.

– Cons: Subject to high volatility, regulatory challenges, rapidly changing industry dynamics.

Pressing Questions

How Can I Invest in Tech Stocks Wisely?

– Diversify: Don’t put all your eggs in one basket. Consider ETFs or mutual funds that focus on the tech sector to spread risk.

– Conduct Research: Stay informed about technology trends and individual company performance.

– Long-Term Strategy: Tech stocks can be volatile; consider a long-term investment strategy to ride out market fluctuations.

Are Tech Stocks Overvalued?

Analysts often debate this; while some say valuations are stretched, others argue that high valuations are justified by strong earnings potential and growth prospects.

What Are the Risks of Investing in Tech Stocks?

Primary risks include market volatility, regulatory scrutiny (e.g., antitrust issues), and rapid technological changes which may render existing technologies obsolete.

Actionable Tips

1. Keep Learning: Regularly update your knowledge on tech trends and forecasts.

2. Monitor Financial News: Stay updated with companies’ quarterly earnings and market developments.

3. Review Your Portfolio: Adjust your investments in alignment with financial goals and risk tolerance.

For more in-depth insights into investing and technology trends, visit Investopedia for comprehensive financial education.